1. What is the Bond Equivalent Yield Calculator?

Definition: This calculator computes the bond equivalent yield (\( BEY \)) and discount (\( D \)), representing the annualized yield of a discount bond based on its price, face value, and time to maturity.

Purpose: Helps investors compare the yield of short-term bonds or Treasury bills with other investments by annualizing the return on a 365-day basis.

2. How Does the Calculator Work?

The calculator follows a four-step process to compute the results:

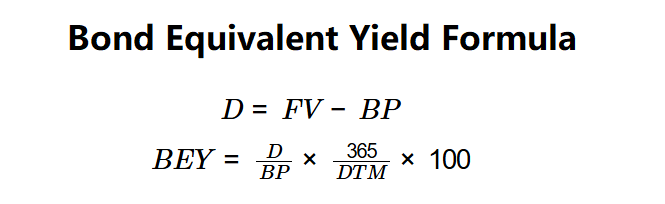

Formulas:

\( D = FV - BP \)

\( BEY = \frac{D}{BP} \times \frac{365}{DTM} \times 100 \)

Where:

- \( BEY \): Bond Equivalent Yield (%)

- \( D \): Discount (dollars)

- \( FV \): Face Value (dollars)

- \( BP \): Bond Price (dollars)

- \( DTM \): Days to Maturity

Steps:

- Step 1: Determine bond price. Use the market price of the bond (\( BP \)).

- Step 2: Determine face value. Use the bond’s principal amount at maturity (\( FV \)).

- Step 3: Determine days to maturity. Use the number of days until the bond matures (\( DTM \)).

- Step 4: Compute discount and BEY. Calculate \( D = FV - BP \) and apply \( BEY = \frac{D}{BP} \times \frac{365}{DTM} \times 100 \).

3. Importance of Bond Equivalent Yield

Calculating the BEY and discount is crucial for:

- Yield Comparison: \( BEY \) standardizes yields for bonds with maturities less than a year, enabling comparison with other investments.

- Investment Decisions: \( D \) shows the potential gain at maturity, aiding in assessing bond profitability.

- Short-Term Bonds: Useful for evaluating Treasury bills or zero-coupon bonds with short maturities.

4. Using the Calculator

Example (Bond A): \( BP = \$980 \), \( FV = \$1,000 \), \( DTM = 300 \):

- Step 1: \( BP = \$980 \).

- Step 2: \( FV = \$1,000 \).

- Step 3: \( DTM = 300 \).

- Step 4:

- \( D = 1,000 - 980 = \$20 \).

- \( BEY = \frac{20}{980} \times \frac{365}{300} \times 100 = 2.48\% \).

- Results: \( D = \$20 \), \( BEY = 2.48\% \).

A BEY of 2.48% indicates the annualized return for a bond maturing in 300 days, purchased at a discount.

Example 2: \( BP = \$950 \), \( FV = \$1,000 \), \( DTM = 180 \):

- Step 1: \( BP = \$950 \).

- Step 2: \( FV = \$1,000 \).

- Step 3: \( DTM = 180 \).

- Step 4:

- \( D = 1,000 - 950 = \$50 \).

- \( BEY = \frac{50}{950} \times \frac{365}{180} \times 100 = 10.67\% \).

- Results: \( D = \$50 \), \( BEY = 10.67\% \).

A higher BEY of 10.67% reflects a larger discount and shorter maturity period.

Example 3: \( BP = \$990 \), \( FV = \$1,000 \), \( DTM = 360 \):

- Step 1: \( BP = \$990 \).

- Step 2: \( FV = \$1,000 \).

- Step 3: \( DTM = 360 \).

- Step 4:

- \( D = 1,000 - 990 = \$10 \).

- \( BEY = \frac{10}{990} \times \frac{365}{360} \times 100 = 1.02\% \).

- Results: \( D = \$10 \), \( BEY = 1.02\% \).

A low BEY of 1.02% indicates a small discount and near-full-year maturity.

5. Frequently Asked Questions (FAQ)

Q: Why is BEY useful for short-term bonds?

A: BEY annualizes the yield of bonds with maturities less than a year, allowing comparison with other investments on a 365-day basis

Q: What does the discount represent?

A: \( D \) is the difference between face value and bond price, reflecting the investor’s potential gain at maturity if held to term.

Q: Can BEY be negative?

A: No, since \( FV \geq BP \) and \( DTM > 0 \), BEY is typically positive. Negative BEY would imply invalid inputs (e.g., \( BP > FV \)).

Bond Equivalent Yield Calculator© - All Rights Reserved 2025

Home

Home

Back

Back