1. What is the Bond Current Yield Calculator?

Definition: This calculator computes the coupon payment per period (\( C_p \)), annual coupon (\( C_a \)), and bond current yield (\( CY \)), representing the periodic and annual coupon payments and the annual return from coupons relative to the bond’s market price.

Purpose: Helps investors evaluate a bond’s income-generating potential and cash flow characteristics based on its current market price, aiding investment decisions.

2. How Does the Calculator Work?

The calculator follows a three-step process to compute the results:

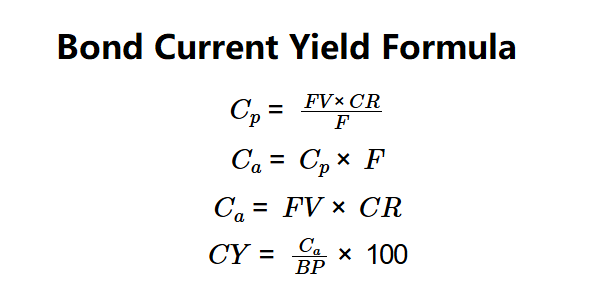

Formulas:

\( C_p = \frac{FV \times CR}{F} \)

\( C_a = C_p \times F \)

\( C_a = FV \times CR \)

\( CY = \frac{C_a}{BP} \times 100 \)

Where:

- \( CY \): Bond Current Yield (%)

- \( C_p \): Coupon Payment per Period (dollars)

- \( C_a \): Annual Coupon (dollars)

- \( FV \): Face Value (dollars)

- \( CR \): Coupon Rate (decimal)

- \( F \): Coupon Frequency (per year)

- \( BP \): Bond Price (dollars)

Steps:

- Step 1: Calculate coupon per period and annual coupon. Use \( C_p = \frac{FV \times CR}{F} \) and \( C_a = C_p \times F \) (or \( C_a = FV \times CR \)).

- Step 2: Determine bond price. Use the provided market price of the bond.

- Step 3: Compute current yield. Apply \( CY = \frac{C_a}{BP} \times 100 \).

3. Importance of Bond Current Yield

Calculating these metrics is crucial for:

- Income Assessment: \( CY \) shows the annual return from coupons relative to the bond’s market price, useful for income-focused investors.

- Cash Flow Clarity: \( C_p \) and \( C_a \) quantify periodic and yearly coupon payments, aiding financial planning.

- Investment Comparison: Allows comparison of bonds with different prices, coupon rates, and frequencies.

4. Using the Calculator

Example (Bond A): \( FV = \$1,000 \), \( F = 2 \), \( CR = 5\% \), \( BP = \$900 \):

- Step 1:

- \( C_p = \frac{1,000 \times 0.05}{2} = \$25 \).

- \( C_a = 25 \times 2 = \$50 \) (or \( C_a = 1,000 \times 0.05 = \$50 \)).

- Step 2: \( BP = \$900 \).

- Step 3: \( CY = \frac{50}{900} \times 100 = 5.56\% \).

- Results: \( C_p = \$25 \), \( C_a = \$50 \), \( CY = 5.56\% \).

A current yield of 5.56% indicates a higher return than the coupon rate due to the bond trading at a discount.

Example 2: \( FV = \$1,000 \), \( F = 1 \), \( CR = 4\% \), \( BP = \$950 \):

- Step 1:

- \( C_p = \frac{1,000 \times 0.04}{1} = \$40 \).

- \( C_a = 40 \times 1 = \$40 \) (or \( C_a = 1,000 \times 0.04 = \$40 \)).

- Step 2: \( BP = \$950 \).

- Step 3: \( CY = \frac{40}{950} \times 100 = 4.21\% \).

- Results: \( C_p = \$40 \), \( C_a = \$40 \), \( CY = 4.21\% \).

A 4.21% yield reflects a bond trading at a slight discount, offering a higher return than its coupon rate.

Example 3: \( FV = \$1,000 \), \( F = 4 \), \( CR = 6\% \), \( BP = \$1,050 \):

- Step 1:

- \( C_p = \frac{1,000 \times 0.06}{4} = \$15 \).

- \( C_a = 15 \times 4 = \$60 \) (or \( C_a = 1,000 \times 0.06 = \$60 \)).

- Step 2: \( BP = \$1,050 \).

- Step 3: \( CY = \frac{60}{1,050} \times 100 = 5.71\% \).

- Results: \( C_p = \$15 \), \( C_a = \$60 \), \( CY = 5.71\% \).

A 5.71% yield is lower than the coupon rate due to the bond trading at a premium.

5. Frequently Asked Questions (FAQ)

Q: Why calculate coupon per period?

A: \( C_p \) shows the cash flow received each period, essential for understanding payment schedules, especially with non-annual frequencies.

Q: How does current yield differ from yield to maturity?

A: \( CY \) considers only annual coupon payments relative to the bond’s price, while yield to maturity includes all cash flows, including price changes at maturity.

Q: Can current yield be negative?

A: No, since \( C_a \) and \( BP \) are typically positive. Negative yields would imply invalid inputs or a zero-coupon bond.

Bond Current Yield Calculator© - All Rights Reserved 2025

Home

Home

Back

Back