Home

Home

Back

Back

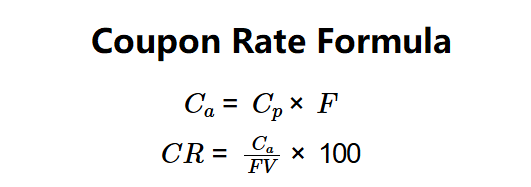

Definition: This calculator computes the annual coupon payment (\( C_a \)) and coupon rate (\( CR \)), representing the total yearly interest paid by a bond and the annual interest rate relative to its face value.

Purpose: Helps investors determine a bond’s fixed interest rate and income stream, aiding in bond evaluation and comparison.

The calculator follows a three-step process to compute the results:

Formulas:

Steps:

Calculating the coupon rate and annual coupon payment is crucial for:

Example (Bond A): \( FV = \$1,000 \), \( C_p = \$25 \), \( F = 2 \):

A coupon rate of 5% indicates the bond pays 5% of its face value annually as interest.

Example 2: \( FV = \$1,000 \), \( C_p = \$40 \), \( F = 1 \):

A coupon rate of 4% reflects an annual interest payment of $40.

Example 3: \( FV = \$2,000 \), \( C_p = \$30 \), \( F = 4 \):

A coupon rate of 6% indicates quarterly payments totaling $120 annually.

Q: What is the coupon rate?

A: The coupon rate (\( CR \)) is the annual interest rate paid by a bond, expressed as a percentage of its face value.

Q: How does frequency affect the coupon rate?

A: The coupon rate (\( CR \)) is independent of frequency (\( F \)), but frequency determines how the annual coupon (\( C_a \)) is split into periodic payments (\( C_p \)).

Q: Can the coupon rate be negative?

A: No, since \( C_a \) and \( FV \) are typically positive or non-negative, \( CR \) is non-negative.