Home

Home

Back

Back

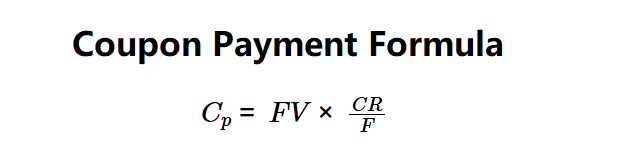

Definition: This calculator computes the coupon payment per period (\( C_p \)), representing the periodic interest payment a bondholder receives based on the bond’s face value and coupon rate.

Purpose: Helps investors determine the cash flow received per payment period, aiding in income planning and bond evaluation.

The calculator uses a single formula to compute the result:

Formula:

Steps:

Calculating the coupon payment per period is crucial for:

Example 1: \( FV = \$1,000 \), \( CR = 10\% \), \( F = 2 \):

A coupon payment of $50 is received semi-annually.

Example 2: \( FV = \$1,000 \), \( CR = 5\% \), \( F = 1 \):

A coupon payment of $50 is received annually.

Example 3: \( FV = \$2,000 \), \( CR = 8\% \), \( F = 4 \):

A coupon payment of $40 is received quarterly.

Q: What is a coupon payment?

A: The coupon payment (\( C_p \)) is the periodic interest payment made to bondholders, based on the bond’s face value and coupon rate.

Q: Why does frequency affect coupon payment?

A: Higher frequency (\( F \)) reduces \( C_p \) by spreading the annual coupon over more payments, maintaining the same total annual interest.

Q: Can coupon payment be negative?

A: No, since \( FV \), \( CR \), and \( F \) are positive or non-negative, \( C_p \) is always non-negative.