1. What is the Bond Convexity Calculator?

Definition: This calculator computes the bond convexity (\( C \)), annual coupon (\( C_a \)), coupon per period (\( C_p \)), and bond price (\( BP \)), measuring the bond's price sensitivity to interest rate changes and its cash flow characteristics.

Purpose: Assists investors and analysts in evaluating interest rate risk, estimating bond price changes, and understanding coupon payments for bonds with varying frequencies.

2. How Does the Calculator Work?

The calculator follows a four-step process to compute the results:

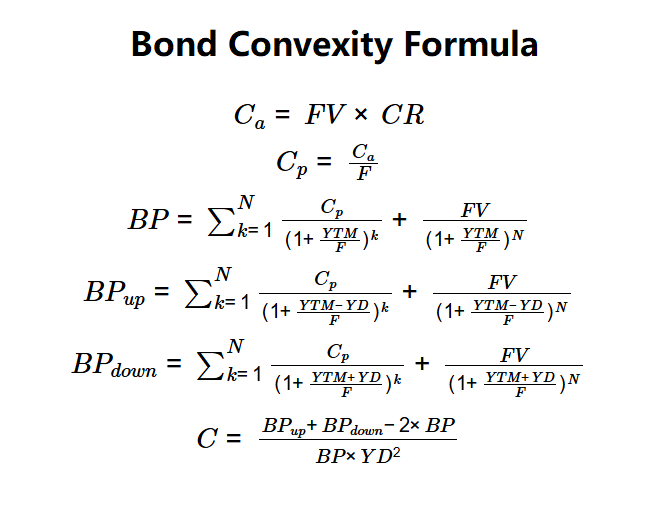

Formulas:

\( C_a = FV \times CR \)

\( C_p = \frac{C_a}{F} \)

\( BP = \sum_{k=1}^{N} \frac{C_p}{(1 + \frac{YTM}{F})^k} + \frac{FV}{(1 + \frac{YTM}{F})^N} \)

\( BP_{up} = \sum_{k=1}^{N} \frac{C_p}{(1 + \frac{YTM - YD}{F})^k} + \frac{FV}{(1 + \frac{YTM - YD}{F})^N} \)

\( BP_{down} = \sum_{k=1}^{N} \frac{C_p}{(1 + \frac{YTM + YD}{F})^k} + \frac{FV}{(1 + \frac{YTM + YD}{F})^N} \)

\( C = \frac{BP_{up} + BP_{down} - 2 \times BP}{BP \times YD^2} \)

Where:

- \( C \): Bond Convexity

- \( C_a \): Annual Coupon (dollars)

- \( C_p \): Coupon per Period (dollars)

- \( BP \): Bond Price (dollars)

- \( BP_{up} \): Upward Bond Price (dollars, at YTM - YD)

- \( BP_{down} \): Downward Bond Price (dollars, at YTM + YD)

- \( FV \): Face Value (dollars)

- \( CR \): Annual Coupon Rate (decimal)

- \( F \): Coupon Frequency (per year)

- \( YTM \): Yield to Maturity (decimal)

- \( YD \): Yield Differential (decimal)

- \( N \): Total Periods (\( Years \times F \))

Steps:

- Step 1: Calculate annual coupon and coupon per period. Use \( C_a = FV \times CR \) and \( C_p = \frac{C_a}{F} \).

- Step 2: Calculate bond price. Sum the present value of coupons and face value discounted at YTM.

- Step 3: Calculate upward and downward bond prices. Recalculate bond prices at YTM ± yield differential.

- Step 4: Compute convexity. Apply the effective convexity formula to measure price-yield curvature.

3. Importance of Bond Convexity and Related Metrics

Calculating these metrics is crucial for:

- Interest Rate Risk: Convexity (\( C \)) refines price change estimates for large yield shifts, complementing duration.

- Cash Flow Analysis: Annual coupon (\( C_a \)) and coupon per period (\( C_p \)) clarify the bond’s income stream.

- Valuation: Bond price (\( BP \)) reflects the bond’s current market value, aiding investment decisions.

4. Using the Calculator

Example (Bond Alpha): \( FV = \$1,000 \), \( CR = 5\% \), \( F = 1 \), Years = 10, \( YTM = 8\% \), \( YD = 1\% \):

- Step 1:

- \( C_a = 1,000 \times 0.05 = \$50 \).

- \( C_p = \frac{50}{1} = \$50 \).

- Step 2: \( BP = \sum_{k=1}^{10} \frac{50}{(1 + 0.08)^k} + \frac{1,000}{(1 + 0.08)^{10}} = \$798.70 \).

- Step 3:

- \( BP_{up} = \sum_{k=1}^{10} \frac{50}{(1 + 0.07)^k} + \frac{1,000}{(1 + 0.07)^{10}} = \$859.53 \) (at 7%).

- \( BP_{down} = \sum_{k=1}^{10} \frac{50}{(1 + 0.09)^k} + \frac{1,000}{(1 + 0.09)^{10}} = \$743.29 \) (at 9%).

- Step 4: \( C = \frac{859.53 + 743.29 - 2 \times 798.70}{798.70 \times 0.01^2} = 67.95 \).

- Results: \( C_a = \$50 \), \( C_p = \$50 \), \( BP = \$798.70 \), \( C = 67.95 \).

These results provide a comprehensive view of the bond’s cash flows, value, and interest rate sensitivity.

Example 2: \( FV = \$1,000 \), \( CR = 6\% \), \( F = 2 \), Years = 5, \( YTM = 7\% \), \( YD = 0.5\% \):

- Step 1:

- \( C_a = 1,000 \times 0.06 = \$60 \).

- \( C_p = \frac{60}{2} = \$30 \).

- Step 2: \( BP = \sum_{k=1}^{10} \frac{30}{(1 + \frac{0.07}{2})^k} + \frac{1,000}{(1 + \frac{0.07}{2})^{10}} = \$958.42 \).

- Step 3:

- \( BP_{up} = \sum_{k=1}^{10} \frac{30}{(1 + \frac{0.065}{2})^k} + \frac{1,000}{(1 + \frac{0.065}{2})^{10}} = \$974.92 \) (at 6.5%).

- \( BP_{down} = \sum_{k=1}^{10} \frac{30}{(1 + \frac{0.075}{2})^k} + \frac{1,000}{(1 + \frac{0.075}{2})^{10}} = \$942.15 \) (at 7.5%).

- Step 4: \( C = \frac{974.92 + 942.15 - 2 \times 958.42}{958.42 \times 0.005^2} = 91.32 \).

- Results: \( C_a = \$60 \), \( C_p = \$30 \), \( BP = \$958.42 \), \( C = 91.32 \).

Semi-annual coupons reduce per-period payments but increase convexity due to frequent cash flows.

Example 3: \( FV = \$1,000 \), \( CR = 4\% \), \( F = 1 \), Years = 15, \( YTM = 6\% \), \( YD = 1\% \):

- Step 1:

- \( C_a = 1,000 \times 0.04 = \$40 \).

- \( C_p = \frac{40}{1} = \$40 \).

- Step 2: \( BP = \sum_{k=1}^{15} \frac{40}{(1 + 0.06)^k} + \frac{1,000}{(1 + 0.06)^{15}} = \$841.15 \).

- Step 3:

- \( BP_{up} = \sum_{k=1}^{15} \frac{40}{(1 + 0.05)^k} + \frac{1,000}{(1 + 0.05)^{15}} = \$898.12 \) (at 5%).

- \( BP_{down} = \sum_{k=1}^{15} \frac{40}{(1 + 0.07)^k} + \frac{1,000}{(1 + 0.07)^{15}} = \$789.45 \) (at 7%).

- Step 4: \( C = \frac{898.12 + 789.45 - 2 \times 841.15}{841.15 \times 0.01^2} = 143.23 \).

- Results: \( C_a = \$40 \), \( C_p = \$40 \), \( BP = \$841.15 \), \( C = 143.23 \).

Longer maturity increases convexity, while lower coupons reduce cash flows.

5. Frequently Asked Questions (FAQ)

Q: Why include annual coupon and coupon per period?

A: \( C_a \) and \( C_p \) clarify the bond’s income stream, especially for bonds with non-annual frequencies, aiding cash flow planning.

Q: How does bond price relate to convexity?

A: \( BP \) is the baseline for convexity calculations, as convexity measures how \( BP \) changes with yield shifts.

Q: Can convexity be negative?

A: Yes, for bonds with embedded options (e.g., callable bonds), negative convexity can occur at certain yield levels.

Bond Convexity Calculator© - All Rights Reserved 2025

Home

Home

Back

Back