Home

Home

Back

Back

Definition: The Blended Rate Calculator determines the equivalent interest rate for multiple loans or debts with different balances and interest rates, combining them into a single rate for a given period.

Purpose: This tool helps borrowers understand the overall cost of multiple loans, such as mortgages or credit lines, to make informed financial decisions, especially when consolidating or adding new debt.

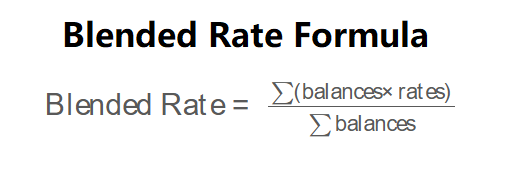

The calculator uses the following formula:

\( \text{Blended Rate} = \frac{\sum (\text{balances} \times \text{rates})}{\sum \text{balances}} \)

Where:

Steps:

Calculating the blended rate is essential for:

Example 1: Calculate the blended rate for three loans: $2,000 at 2%, $3,000 at 4%, and $200 at 3%:

Example 2: Calculate the blended rate for a $100,000 mortgage at 2.5% and an additional $20,000 at 4%:

Q: What is a blended rate?

A: A blended rate is the weighted average interest rate of multiple loans or debts, calculated based on their balances and rates.

Q: Why use a blended rate?

A: It simplifies the understanding of the combined cost of multiple loans, aiding in financial planning and decision-making.

Q: When is the blended rate useful?

A: It’s useful when consolidating loans, adding new debt, or comparing financing options to assess overall interest costs.