Home

Home

Back

Back

Definition: The Balloon Payment Calculator estimates the monthly payment and final lump-sum balloon payment for a partially amortized loan, such as a balloon mortgage, where only a portion of the principal is paid off during the payment term, leaving a large balance due at the end.

Purpose: This tool helps borrowers plan for loans with low monthly payments and a significant final payment, often used in commercial real estate or car loans, to assess affordability and financial strategy.

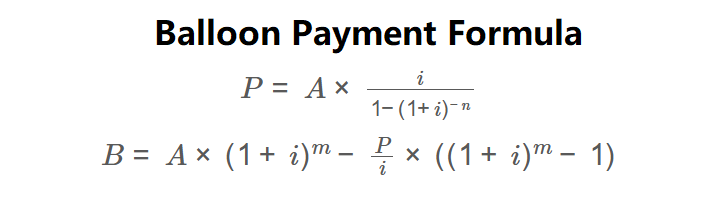

The calculator uses the following formulas:

\( P = A \times \frac{i}{1 - (1 + i)^{-n}} \)

\( B = A \times (1 + i)^m - \frac{P}{i} \times ((1 + i)^m - 1) \)

Where:

Steps:

Calculating balloon payments is essential for:

Example: Calculate the monthly and balloon payments for a $100,000 loan with a 7% interest rate, 30-year amortization term, and 5-year payment term:

The house must be sold for at least $94,131.59 to cover the balloon payment.

Q: What is a balloon payment?

A: A balloon payment is a large, one-time payment due at the end of a partially amortized loan term, covering the remaining balance.

Q: Why use a balloon loan?

A: Balloon loans offer lower monthly payments, making them suitable for short-term financing or borrowers planning to sell an asset before the balloon payment is due.

Q: What are the risks of a balloon loan?

A: Risks include inability to make the large balloon payment, requiring refinancing or asset sale, which may be affected by market conditions or financial changes.