Home

Home

Back

Back

Definition: This calculator computes the average fixed cost (AFC), which is the fixed cost per unit produced by a company. Fixed costs are expenses that do not change with the level of production, such as rent, depreciation, or salaries.

Purpose: It is used by businesses to analyze operational efficiency, particularly in capital-intensive industries like manufacturing, where fixed assets (e.g., machinery, buildings) are significant investments. A lower AFC indicates better utilization of fixed assets.

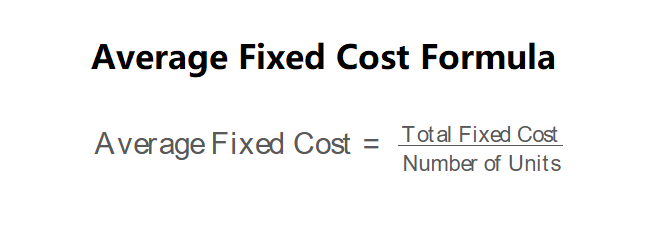

The calculator uses the average fixed cost formula, as shown in the image above:

\( \text{Average Fixed Cost} = \frac{\text{Total Fixed Cost}}{\text{Number of Units}} \)

Where:

Steps:

Calculating the average fixed cost is essential for:

Example 1: Calculate the average fixed cost for a company with a total fixed cost of $250,000 and 20,000 units produced:

Example 2: Calculate the average fixed cost for a company with a total fixed cost of $100,000 and 5,000 units produced:

Q: What is an average fixed cost?

A: The average fixed cost (AFC) is the fixed cost per unit produced, calculated by dividing the total fixed cost by the number of units.

Q: Can the average fixed cost be negative?

A: No, the average fixed cost cannot be negative because both the total fixed cost and the number of units produced are non-negative values.

Q: What does a high average fixed cost indicate?

A: A high AFC suggests that the company may not be utilizing its fixed assets efficiently, as the fixed costs are spread over fewer units. It may indicate a need to increase production or reduce fixed costs.