Home

Home

Back

Back

Definition: This calculator computes the future value (\( \text{finVal} \)) of an asset or product based on its starting value, annual appreciation rate, and time period. It is useful for financial planning, real estate valuation, and investment analysis.

Purpose: Investors, homeowners, and financial planners use this tool to estimate the future worth of assets like homes, collectibles, or investments, aiding in decision-making and forecasting.

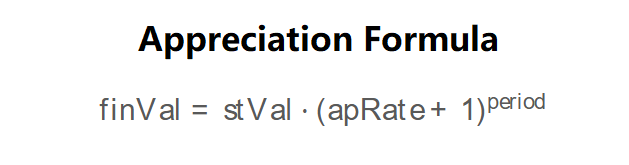

The calculator uses the following formula, as shown in the image above:

\( \text{finVal} = \text{stVal} \cdot (\text{apRate} + 1)^{\text{period}} \)

Where:

Steps:

Calculating appreciation is essential for:

Example 1: Calculate the future value of a house worth $200,000 with an appreciation rate of 5% per year over 120 months, in USD:

Example 2: Calculate the future value of an investment worth €50,000 with an appreciation rate of 3% per year over 1825 days, in EUR:

Q: How accurate is the appreciation calculation?

A: The formula assumes a constant annual appreciation rate, which may not reflect real-world fluctuations. It provides a good estimate for stable growth scenarios.

Q: Can I use this for depreciation instead?

A: Yes, by entering a negative appreciation rate (e.g., -5% for 5% depreciation). However, a dedicated depreciation calculator might be more suitable.

Q: Why are there multiple time units for the period?

A: Different users prefer different time scales (e.g., daily for short-term assets, yearly for long-term investments). The calculator converts all periods to years for consistency in calculation.