Home

Home

Back

Back

Definition: The Annuity Payout Calculator computes the regular withdrawal amount from an annuity based on the initial balance, interest rate, number of years, and compounding frequency.

Purpose: Helps retirees, investors, and financial planners determine how much can be withdrawn periodically from an annuity to deplete it over a specified period.

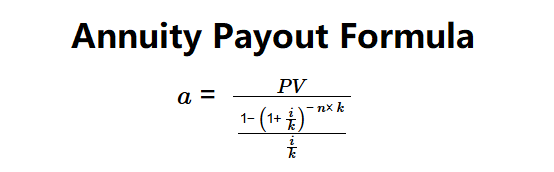

The calculator computes the regular withdrawal amount using the following formula:

Formula:

Steps:

Calculating annuity payouts is crucial for:

Example: Initial balance = $100,000, Interest rate = 5%, Number of years = 10, Compounding = Monthly:

This shows the monthly payout to deplete the annuity in 10 years.

Q: What is an annuity payout?

A: An annuity payout is a regular withdrawal from an annuity account, designed to deplete the balance over a specified period while earning interest.

Q: Why does compounding frequency matter?

A: More frequent compounding (e.g., monthly vs. annually) increases the effective interest rate, affecting the withdrawal amount.

Q: Can this calculator handle negative interest rates?

A: The calculator assumes a non-negative interest rate, as negative rates are uncommon for annuities.