1. What is the Annuity Future Value Calculator?

Definition: The Annuity Future Value Calculator computes the future value of a series of regular payments, accounting for interest, compounding frequency, payment frequency, annuity type, and optional growth rate.

Purpose: Helps investors and financial planners estimate the future value of savings, investments, or retirement contributions with fixed or growing payments.

2. How Does the Calculator Work?

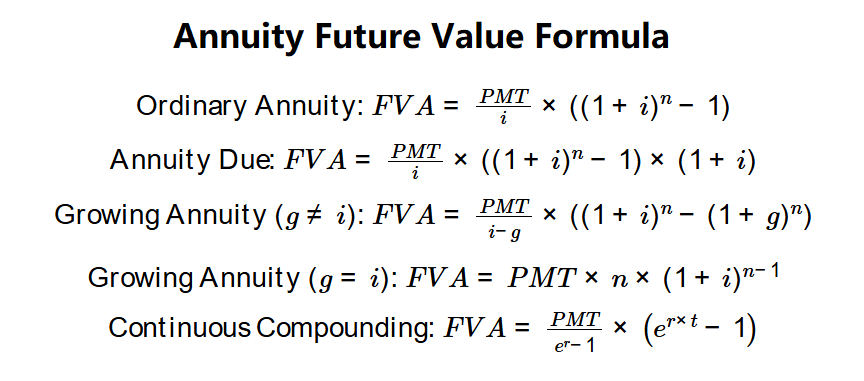

The calculator uses the following formulas based on the annuity type and conditions:

Formulas:

\(\text{Ordinary Annuity: } FVA = \frac{PMT}{i} \times \left( (1 + i)^n - 1 \right)\)

\(\text{Annuity Due: } FVA = \frac{PMT}{i} \times \left( (1 + i)^n - 1 \right) \times (1 + i)\)

\(\text{Growing Annuity (} g \neq i \text{): } FVA = \frac{PMT}{i - g} \times \left( (1 + i)^n - (1 + g)^n \right)\)

\(\text{Growing Annuity (} g = i \text{): } FVA = PMT \times n \times (1 + i)^{n - 1}\)

\(\text{Continuous Compounding: } FVA = \frac{PMT}{e^r - 1} \times \left( e^{r \times t} - 1 \right)\)

Where:

- \( FVA \): Future value of the annuity ($)

- \( PMT \): Payment amount per period ($)

- \( i \): Periodic interest rate (\( r / m \))

- \( r \): Annual interest rate

- \( g \): Growth rate per period

- \( n \): Total number of payment periods (\( m \times t \))

- \( m \): Compounding frequency per year

- \( t \): Number of years

- \( e \): Exponential constant (~2.718)

Steps:

- Step 1: Input Payment Amount. Enter the periodic payment (e.g., $1000).

- Step 2: Input Interest Rate. Enter the annual interest rate (e.g., 5%).

- Step 3: Input Number of Years. Enter the duration of the annuity (e.g., 10 years).

- Step 4: Select Compounding Frequency. Choose monthly, quarterly, annual, or continuous compounding.

- Step 5: Select Payment Frequency. Choose monthly, quarterly, or annual payments.

- Step 6: Select Annuity Type. Choose ordinary (end of period) or due (beginning of period).

- Step 7: Growing Annuity (Optional). Enable growing annuity and input growth rate (e.g., 2%).

- Step 8: Calculate. Compute the future value using the appropriate formula.

3. Importance of Annuity Future Value Calculation

Calculating the future value of an annuity is crucial for:

- Retirement Planning: Estimates growth of regular contributions for retirement savings.

- Investment Analysis: Evaluates the value of recurring investments or savings plans.

- Financial Forecasting: Supports budgeting for future financial goals with fixed or growing payments.

4. Using the Calculator

Example:

Payment amount = $1000, Interest rate = 5%, Number of years = 10, Compounding = Monthly, Payment = Monthly, Type = Ordinary, Growth rate = 0:

- Step 1: \( PMT \) = $1000.

- Step 2: \( r \) = 0.05.

- Step 3: \( t \) = 10.

- Step 4: \( m \) = 12.

- Step 5: \( q \) = 12.

- Step 6: Type = Ordinary.

- Step 7: \( g \) = 0.

- Step 8: \( i = 0.05 / 12 \approx 0.004167 \), \( n = 10 \times 12 = 120 \), \( FVA = \frac{1000}{0.004167} \times \left( (1 + 0.004167)^{120} - 1 \right) \approx 155,296 \).

- Result: Future value = $155,296.00.

This shows the future value of the annuity.

5. Frequently Asked Questions (FAQ)

Q: What is the difference between ordinary annuity and annuity due?

A: Ordinary annuities have payments at the end of each period, while annuities due have payments at the beginning, increasing the future value due to earlier interest accrual.

Q: Why include continuous compounding?

A: Continuous compounding represents the theoretical maximum frequency, useful for precise financial modeling.

Q: Can this calculator handle negative growth rates?

A: Yes, but negative growth rates are uncommon and may reduce the future value significantly.

Annuity Future Value Calculator© - All Rights Reserved 2025

Home

Home

Back

Back