1. What is the Annual Salary Calculator?

Definition: The Annual Salary Calculator computes the gross annual salary from hourly wage, working hours, and weeks, and estimates the net salary and net hourly wage after taxes.

Purpose: Helps workers and financial planners estimate yearly earnings and take-home pay for budgeting in 2025.

2. How Does the Calculator Work?

The calculator computes the gross and net salaries using the following formulas and steps:

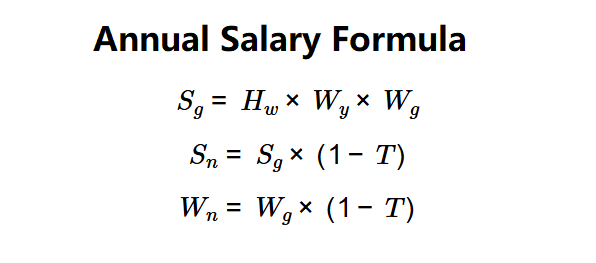

Formulas:

\( S_g = H_w \times W_y \times W_g \)

\( S_n = S_g \times (1 - T) \)

\( W_n = W_g \times (1 - T) \)

Where:

- \( H_w \): Working hours per week (hours)

- \( W_y \): Working weeks per year (weeks)

- \( W_g \): Gross hourly wage ($)

- \( T \): Tax rate as a fraction (e.g., 12% = 0.12)

- \( S_g \): Gross annual salary ($)

- \( S_n \): Net annual salary ($)

- \( W_n \): Net hourly wage ($)

Steps:

- Step 1: Input Working Hours per Week. Enter the number of hours worked weekly (e.g., 40).

- Step 2: Input Working Weeks per Year. Enter the number of weeks worked annually (e.g., 52).

- Step 3: Input Gross Hourly Wage. Enter the hourly wage before taxes.

- Step 4: Calculate Gross Annual Salary. Multiply hours per week, weeks per year, and hourly wage.

- Step 5: Input Tax Rate (Optional). Enter the tax rate as a percentage to calculate net values.

- Step 6: Calculate Net Salary and Wage. Multiply gross salary and hourly wage by (1 − tax rate fraction).

3. Importance of Annual Salary Calculation

Calculating annual salary is crucial for:

- Budgeting: Helps plan expenses based on gross and net earnings in 2025.

- Job Evaluation: Assists in comparing job offers by estimating yearly income.

- Financial Planning: Supports setting savings and investment goals after taxes.

4. Using the Calculator

Example:

Working hours per week = 40, Working weeks per year = 52, Gross hourly wage = $20, Tax rate = 12%:

- Step 1: \( H_w \) = 40 hours.

- Step 2: \( W_y \) = 52 weeks.

- Step 3: \( W_g \) = $20.

- Step 4: \( S_g = 40 \times 52 \times 20 = 41,600 \).

- Step 5: \( T \) = 12 / 100 = 0.12.

- Step 6: \( S_n = 41,600 \times (1 - 0.12) = 36,608 \).

\( W_n = 20 \times (1 - 0.12) = 17.6 \).

- Result: Gross annual salary = $41,600, Net annual salary = $36,608, Net hourly wage = $17.60.

This shows the earnings before and after a 12% tax as of July 05, 2025.

5. Frequently Asked Questions (FAQ)

Q: How do I calculate hourly wage from annual salary?

A: Divide the gross annual salary by the product of hours per week and weeks per year: \( W_g = S_g / (H_w \times W_y) \). E.g., $41,600 / (40 × 52) = $20/hr.

Q: What is a typical tax rate?

A: Tax rates vary by region and income level, often ranging from 10% to 37% in the U.S. Check local tax regulations.

Q: Why include tax rate in the calculation?

A: Including \( T \) provides a realistic estimate of take-home pay (\( S_n \), \( W_n \)) after taxes.

Annual Salary Calculator© - All Rights Reserved 2025

Home

Home

Back

Back