Home

Home

Back

Back

Definition: This calculator computes gross (G) and net (N) annual income from hourly wage, weekly hours, and yearly weeks. Gross is total earnings before taxes; net is take-home pay after taxes.

Purpose: Helps employees, freelancers, and job seekers estimate yearly earnings for budgeting, planning, and comparing jobs.

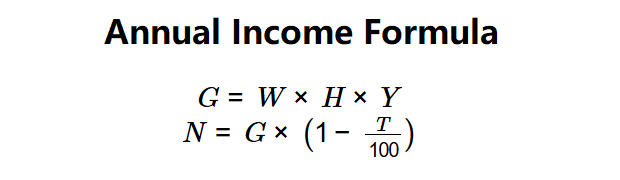

The calculator uses these formulas:

Formulas:

Steps:

Calculating annual income is key for:

Example: \( W = \$34 \), \( H = 40 \), \( Y = 52 \), \( T = 12\% \):

This shows a gross income of $70,720 and net income of $62,233.60 after 12% tax.

Q: What's gross vs. net income?

A: Gross (\( G \)) is total earnings before taxes; net (\( N \)) is after tax deductions.

Q: Can I use this for part-time jobs?

A: Yes, set \( H \) and \( Y \) to match part-time schedules (e.g., 20 hours, 48 weeks).

Q: How do I know my tax rate?

A: Check your tax bracket or ask a tax professional. Use an estimated \( T \) for simplicity.