1. What is the Annual Income After Taxes Calculator?

Definition: The Annual Income After Taxes Calculator computes the net annual salary and net hourly wage after deducting taxes from gross income.

Purpose: Assists individuals and financial planners in estimating take-home pay for budgeting in 2025.

2. How Does the Calculator Work?

The calculator computes net income using the following formulas and steps:

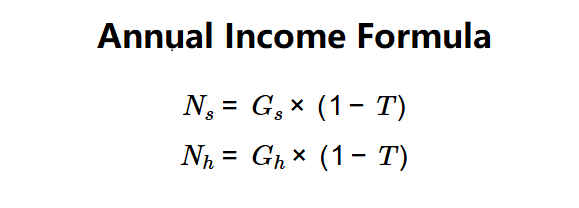

Formulas:

\( N_s = G_s \times (1 - T) \)

\( N_h = G_h \times (1 - T) \)

Where:

- \( G_s \): Gross annual salary ($)

- \( G_h \): Gross hourly wage ($)

- \( T \): Tax rate as a fraction (e.g., 12% = 0.12)

- \( N_s \): Net annual salary ($)

- \( N_h \): Net hourly wage ($)

Steps:

- Step 1: Input Gross Annual Salary. Enter the total annual income before taxes.

- Step 2: Input Gross Hourly Wage. Enter the hourly wage before taxes.

- Step 3: Input Tax Rate. Enter the tax rate as a percentage (e.g., 12%).

- Step 4: Convert Tax Rate. Divide the tax rate by 100 to get the fraction.

- Step 5: Calculate Net Income. Multiply the gross salary and hourly wage by (1 − tax rate fraction).

3. Importance of Annual Income After Taxes Calculation

Calculating net income is crucial for:

- Budgeting: Enables planning expenses based on take-home pay in 2025.

- Financial Planning: Supports setting savings and investment goals post-taxes.

- Salary Negotiations: Clarifies actual earnings for job offer comparisons.

4. Using the Calculator

Example:

Gross annual salary = $50,000, Gross hourly wage = $25, Tax rate = 12%:

- Step 1: \( G_s \) = $50,000.

- Step 2: \( G_h \) = $25.

- Step 3: Tax rate = 12%.

- Step 4: \( T \) = 12 / 100 = 0.12.

- Step 5: \( N_s = 50,000 \times (1 - 0.12) = 44,000 \).

\( N_h = 25 \times (1 - 0.12) = 22 \).

- Result: Net annual salary = $44,000, Net hourly wage = $22.

This shows the take-home pay after a 12% tax deduction as of July 05, 2025.

5. Frequently Asked Questions (FAQ)

Q: What is net annual salary?

A: It’s the income after deducting taxes from the gross annual salary (\( N_s = G_s \times (1 - T) \)).

Q: How do I convert a tax rate to a fraction?

A: Divide the tax rate percentage by 100 (e.g., 12% = 12 / 100 = 0.12).

Q: Can the net salary be negative?

A: No, provided the gross salary and tax rate are valid (\( T \) between 0% and 100%).

Annual Income After Taxes Calculator© - All Rights Reserved 2025

Home

Home

Back

Back