Home

Home

Back

Back

Definition: The Amortization Calculator computes the monthly payment and remaining balance for an amortized loan, such as a mortgage or car loan, based on the loan amount, interest rate, and term.

Purpose: This tool helps borrowers understand their monthly payment obligations and track the remaining balance over time, aiding in financial planning and loan management.

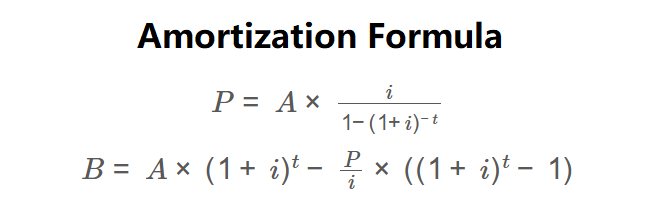

The calculator uses the following formulas:

\( P = A \times \frac{i}{1 - (1 + i)^{-t}} \)

\( B = A \times (1 + i)^t - \frac{P}{i} \times ((1 + i)^t - 1) \)

Where:

Steps:

Calculating amortization is essential for:

Example: Calculate the monthly payment and remaining balance for a $10,000 loan with a 6% annual interest rate over 5 years, after 36 payments:

Q: What is an amortized loan?

A: An amortized loan is repaid in fixed monthly payments that cover both principal and interest, gradually reducing the balance over the loan term.

Q: Why is the remaining balance useful?

A: Knowing the remaining balance helps borrowers decide whether to refinance, make extra payments, or assess the cost of paying off the loan early.

Q: Can this calculator handle 0% interest loans?

A: Yes, the calculator handles 0% interest by dividing the loan amount by the number of payments for the monthly payment.