Home

Home

Back

Back

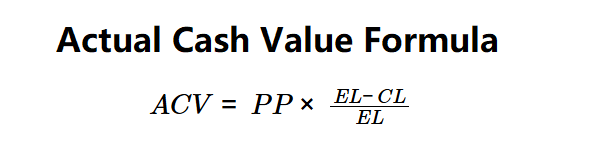

Definition: This calculator computes the actual cash value (\( ACV \)) of a car, which represents its current value after accounting for depreciation based on its age and expected lifespan.

Purpose: Helps car owners, insurers, and buyers determine a vehicle's fair market value, useful for insurance claims, sales, or asset valuation.

The calculator follows a four-step process to compute the actual cash value:

Formula:

Steps:

Calculating the actual cash value is crucial for:

Example 1: \( PP = \$250,000 \), \( EL = 10 \), \( CL = 3 \):

An ACV of $175,000 indicates the car's current value after 3 years of use.

Example 2: \( PP = \$100,000 \), \( EL = 8 \), \( CL = 2 \):

An ACV of $75,000 reflects the car's value after 2 years.

Example 3: \( PP = \$50,000 \), \( EL = 5 \), \( CL = 4 \):

An ACV of $10,000 shows significant depreciation near the end of the car's expected life.

Q: What is the actual cash value?

A: The actual cash value (\( ACV \)) is the current market value of a car, calculated by adjusting its purchase price for depreciation based on its age and expected lifespan.

Q: How does the expected life affect the ACV?

A: A longer \( EL \) results in slower depreciation, increasing the \( ACV \), while a shorter \( EL \) accelerates depreciation, reducing the \( ACV \).

Q: Can the ACV be negative?

A: No, since \( PP \), \( EL \), and \( EL - CL \) are non-negative, the \( ACV \) is always non-negative.