1. What is the Accrual Ratio Calculator?

Definition: This calculator computes the balance sheet accrual ratio (\( BSAR \)) and cash flow accrual ratio (\( CFAR \)), which measure the proportion of a company's earnings derived from accruals rather than cash flows, indicating earnings quality.

Purpose: Helps investors and analysts assess the sustainability of a company's earnings by evaluating the extent to which profits are backed by cash flows versus accounting accruals.

2. How Does the Calculator Work?

The calculator computes two ratios using the following steps and formulas:

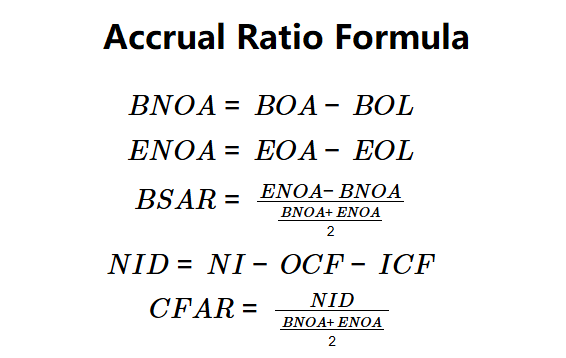

Formulas for Balance Sheet Accrual Ratio:

\( BNOA = BOA - BOL \)

\( ENOA = EOA - EOL \)

\( BSAR = \frac{ENOA - BNOA}{\frac{BNOA + ENOA}{2}} \)

Formulas for Cash Flow Accrual Ratio:

\( NID = NI - OCF - ICF \)

\( CFAR = \frac{NID}{\frac{BNOA + ENOA}{2}} \)

Where:

- \( BNOA \): Beginning Net Operating Assets (dollars)

- \( ENOA \): Ending Net Operating Assets (dollars)

- \( BSAR \): Balance Sheet Accrual Ratio

- \( CFAR \): Cash Flow Accrual Ratio

- \( NID \): Net Income Difference (dollars)

- \( BOA \): Beginning Operating Assets (dollars)

- \( EOA \): Ending Operating Assets (dollars)

- \( BOL \): Beginning Operating Liabilities (dollars)

- \( EOL \): Ending Operating Liabilities (dollars)

- \( NI \): Net Income (dollars)

- \( OCF \): Operating Cash Flow (dollars)

- \( ICF \): Investing Cash Flow (dollars)

Steps for Balance Sheet Accrual Ratio:

- Step 1: Calculate \( BNOA \). Subtract \( BOL \) from \( BOA \).

- Step 2: Calculate \( ENOA \). Subtract \( EOL \) from \( EOA \).

- Step 3: Calculate \( BSAR \). Divide the difference between \( ENOA \) and \( BNOA \) by their average.

Steps for Cash Flow Accrual Ratio:

- Step 1: Calculate \( BNOA \). Same as above.

- Step 2: Calculate \( ENOA \). Same as above.

- Step 3: Calculate \( NID \). Subtract \( OCF \) and \( ICF \) from \( NI \).

- Step 4: Calculate \( CFAR \). Divide \( NID \) by the average of \( BNOA \) and \( ENOA \).

3. Importance of Accrual Ratio Calculation

Calculating accrual ratios is crucial for:

- Earnings Quality: Lower \( BSAR \) and \( CFAR \) indicate earnings are more cash-backed, suggesting higher quality.

- Financial Analysis: Helps identify potential earnings manipulation through accruals.

- Investment Decisions: Enables investors to assess the reliability of reported profits.

4. Using the Calculator

Example 1 (Company Alpha):

\( BOA = \$3,000,000 \),

\( EOA = \$3,500,000 \),

\( BOL = \$2,000,000 \),

\( EOL = \$1,750,000 \),

\( NI = \$1,500,000 \),

\( OCF = \$500,000 \),

\( ICF = \$100,000 \):

- Step 1: \( BNOA = 3,000,000 - 2,000,000 = \$1,000,000 \).

- Step 2: \( ENOA = 3,500,000 - 1,750,000 = \$1,750,000 \).

- Step 3: \( BSAR = (1,750,000 - 1,000,000) / ((1,000,000 + 1,750,000) / 2) = 0.55 \).

- Step 4: \( NID = 1,500,000 - 500,000 - 100,000 = \$900,000 \).

- Step 5: \( CFAR = 900,000 / ((1,000,000 + 1,750,000) / 2) = 0.65 \).

- Results: \( BNOA = \$1,000,000 \), \( ENOA = \$1,750,000 \), \( BSAR = 0.55 \), \( NID = \$900,000 \), \( CFAR = 0.65 \).

A \( BSAR \) of 0.55 and \( CFAR \) of 0.65 indicate moderate reliance on accruals.

Example 2:

\( BOA = \$5,000,000 \),

\( EOA = \$5,500,000 \),

\( BOL = \$3,000,000 \),

\( EOL = \$2,800,000 \),

\( NI = \$2,000,000 \),

\( OCF = \$1,200,000 \),

\( ICF = \$200,000 \):

- Step 1: \( BNOA = 5,000,000 - 3,000,000 = \$2,000,000 \).

- Step 2: \( ENOA = 5,500,000 - 2,800,000 = \$2,700,000 \).

- Step 3: \( BSAR = (2,700,000 - 2,000,000) / ((2,000,000 + 2,700,000) / 2) = 0.30 \).

- Step 4: \( NID = 2,000,000 - 1,200,000 - 200,000 = \$600,000 \).

- Step 5: \( CFAR = 600,000 / ((2,000,000 + 2,700,000) / 2) = 0.26 \).

- Results: \( BNOA = \$2,000,000 \), \( ENOA = \$2,700,000 \), \( BSAR = 0.30 \), \( NID = \$600,000 \), \( CFAR = 0.26 \).

Lower ratios (0.30 and 0.26) suggest higher earnings quality due to less reliance on accruals.

5. Frequently Asked Questions (FAQ)

Q: What is the accrual ratio?

A: The accrual ratio (\( BSAR \) or \( CFAR \)) measures the proportion of earnings from accruals versus cash flows, with \( BSAR \) focusing on changes in net operating assets and \( CFAR \) comparing net income to cash flows.

Q: Why are accrual ratios important?

A: They indicate earnings quality; lower ratios suggest earnings are more cash-backed, reducing manipulation risk.

Q: Can accrual ratios be negative?

A: Yes, if \( ENOA < BNOA \) (\( BSAR \)) or \( NI < (OCF + ICF) \) (\( CFAR \)), ratios can be negative.

Accrual Ratio Calculator© - All Rights Reserved 2025

Home

Home

Back

Back