Home

Home

Back

Back

Definition: This calculator computes the receivables turnover ratio (\( RTR \)), which measures how efficiently a company collects payments from credit sales, and the average accounts receivable (\( AAR \)).

Purpose: Helps businesses assess credit policies, cash flow management, and the effectiveness of accounts receivable collection processes.

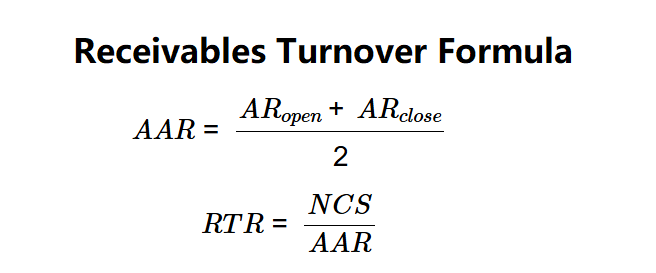

The calculator follows a two-step process to compute \( RTR \):

Formulas:

Steps:

Calculating \( RTR \) is crucial for:

Example 1 (Calculator Enterprises Incorporated): \( NCS = \$15,000 \), \( AR_{open} = \$2,000 \), \( AR_{close} = \$3,000 \):

A turnover ratio of 6 indicates the company collects receivables six times per period.

Example 2: \( NCS = \$50,000 \), \( AR_{open} = \$5,000 \), \( AR_{close} = \$7,000 \):

A turnover ratio of 8.33 suggests efficient receivable collection.

Example 3: \( NCS = \$20,000 \), \( AR_{open} = \$4,000 \), \( AR_{close} = \$6,000 \):

A turnover ratio of 4 indicates a slower collection rate, possibly due to extended credit terms.

Q: What is the receivables turnover ratio?

A: The receivables turnover ratio (\( RTR \)) measures how many times a company collects its average accounts receivable over a period.

Q: Why use average accounts receivable?

A: \( AAR \) smooths out fluctuations in receivables over the period, providing a more accurate turnover measure.

Q: What does a low RTR indicate?

A: A low \( RTR \) may suggest slow collection, potential credit issues, or generous payment terms.