Home

Home

Back

Back

Definition: This calculator computes the accounting profit (\( AP \)), also known as bookkeeping or financial profit, which is the net income earned after deducting all explicit costs from total revenue. It represents the money a business retains after covering all direct costs.

Purpose: Helps business owners and investors assess a firm's profitability by quantifying the net income after explicit costs, aiding in financial analysis and decision-making.

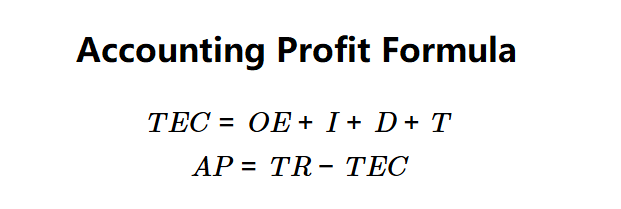

The calculator follows a two-step process to compute the results:

Formulas:

Steps:

Calculating accounting profit is crucial for:

Example 1: \( TR = \$50,000 \), \( OE = \$20,000 \), \( I = \$2,000 \), \( D = \$3,000 \), \( T = \$5,000 \):

An accounting profit of $20,000 indicates the business earned $20,000 after explicit costs.

Example 2: \( TR = \$100,000 \), \( OE = \$60,000 \), \( I = \$5,000 \), \( D = \$10,000 \), \( T = \$15,000 \):

An accounting profit of $10,000 reflects net income after high explicit costs.

Example 3: \( TR = \$25,000 \), \( OE = \$15,000 \), \( I = \$1,000 \), \( D = \$2,000 \), \( T = \$3,000 \):

An accounting profit of $4,000 shows modest earnings after costs.

Q: What is accounting profit?

A: Accounting profit (\( AP \)) is the net income earned after subtracting all explicit costs (operation expenses, interest, depreciation, taxes) from total revenue.

Q: How does accounting profit differ from economic profit?

A: Accounting profit considers only explicit costs, while economic profit also includes implicit costs (e.g., opportunity costs).

Q: Can accounting profit be negative?

A: Yes, if total explicit costs exceed total revenue, the accounting profit will be negative, indicating a loss.