1. What is the Final Deposit Calculator?

Definition: This calculator computes the Final Deposit, which is the future value of an initial investment or deposit after applying the Annual Percentage Yield (APY) over a specified term with a given compounding frequency.

Purpose: Savers and investors use this tool to estimate the growth of their savings or investments, such as in savings accounts, certificates of deposit (CDs), or other interest-bearing accounts, to plan for future financial goals.

2. How Does the Calculator Work?

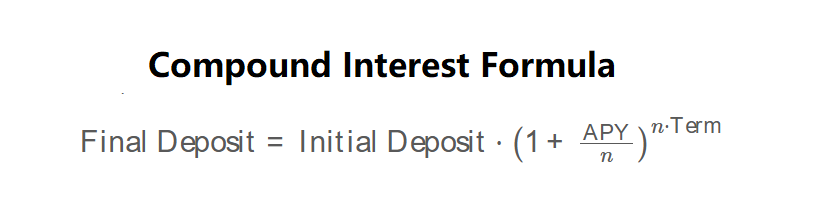

The calculator uses the compound interest formula:

\( \text{Final Deposit} = \text{Initial Deposit} \cdot \left(1 + \frac{\text{APY}}{n}\right)^{n \cdot \text{Term}} \)

Where:

- \( \text{Initial Deposit} \): The starting amount of money (in selected currency);

- \( \text{APY} \): Annual Percentage Yield (as a decimal, e.g., 5% = 0.05);

- \( n \): Number of times the interest is compounded per year;

- \( \text{Term} \): Time period (converted to years);

- \( \text{Final Deposit} \): The amount after compounding (in selected currency).

Steps:

- Enter the Initial Deposit and select the currency (USD, EUR, GBP, JPY).

- Enter the Annual Percentage Yield (\( \text{APY} \)) in percentage (e.g., 5 for 5%).

- Enter the Term and select its unit (Daily, Monthly, Yearly).

- Select the Compound Frequency (\( n \)) from the options: Annually (1), Quarterly (4), Monthly (12), or Daily (365).

- The calculator converts the term to years, converts APY to a decimal, and computes the Final Deposit using the formula above.

- The result is formatted (scientific notation for values < 0.001, otherwise 4 decimal places) and displayed in the selected currency.

3. Importance of Final Deposit Calculation

Calculating the Final Deposit is essential for:

- Financial Planning: Helps predict the future value of savings for budgeting or investment decisions.

- Investment Growth: Estimates the growth of deposits in interest-bearing accounts, aiding in choosing the best savings options.

- Goal Setting: Assists in setting financial goals by showing how much an investment will grow over time.

4. Using the Calculator

Example 1: Calculate the Final Deposit for an initial deposit of $10,000 with an APY of 5%, a term of 2 years, and monthly compounding, in USD:

- Initial Deposit: $10,000;

- APY: 5% = 0.05;

- Term: 2 years;

- Compound Frequency: Monthly = 12;

- Final Deposit: \( 10,000 \cdot \left(1 + \frac{0.05}{12}\right)^{12 \cdot 2} = 10,000 \cdot \left(1 + 0.0041667\right)^{24} = 10,000 \cdot 1.1049 = 11,049.37 \, \text{USD} \).

Example 2: Calculate the Final Deposit for an initial deposit of €5,000 with an APY of 3%, a term of 730 days, and daily compounding, in EUR:

- Initial Deposit: €5,000;

- APY: 3% = 0.03;

- Term: 730 days = \( 730 \div 365 = 2 \) years;

- Compound Frequency: Daily = 365;

- Final Deposit: \( 5,000 \cdot \left(1 + \frac{0.03}{365}\right)^{365 \cdot 2} = 5,000 \cdot \left(1 + 0.00008219\right)^{730} = 5,000 \cdot 1.0618 = 5,309.12 \, \text{EUR} \).

5. Frequently Asked Questions (FAQ)

Q: How accurate is the Final Deposit calculation?

A: The formula is precise for the given inputs, assuming a constant APY. Real-world factors like variable rates or fees may affect the actual amount.

Q: Why does compounding frequency matter?

A: More frequent compounding increases the effective growth because interest is earned on previously accumulated interest more often.

Q: Why are there multiple time units for the term?

A: Different users prefer different time scales (e.g., daily for short-term savings, yearly for long-term investments). The calculator converts all terms to years for consistency in calculation.

Final Deposit Calculator© - All Rights Reserved 2025

Home

Home

Back

Back