Home

Home

Back

Back

Definition: This calculator computes the Funds From Operations (F) and Adjusted Funds From Operations (A) for a Real Estate Investment Trust (REIT). FFO measures operational cash flow, while AFFO adjusts for recurring costs to show cash available for dividends.

Purpose: Helps investors and analysts evaluate a REIT’s financial performance and ability to sustain dividend payments, providing a clearer picture than net income.

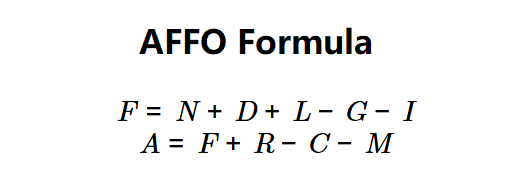

The calculator uses these formulas:

Formulas:

Steps:

Calculating FFO and AFFO is key for:

Example: For REIT Alpha with \( N = \$500,000 \), \( D = \$150,000 \), \( G = \$125,000 \), \( L = \$80,000 \), \( I = \$75,000 \), \( R = \$50,000 \), \( C = \$60,000 \), \( M = \$35,000 \):

This shows REIT Alpha generates $530,000 in operational cash flow and $485,000 available for dividends after recurring costs.

Q: How is AFFO calculated?

A: AFFO is calculated in two steps: (1) Compute FFO using \( F = N + D + L - G - I \), where non-cash expenses (D) and losses (L) are added back to net income (N), and gains (G) and interest income (I) are subtracted. (2) Adjust FFO for recurring costs using \( A = F + R - C - M \), adding rent increases (R) and subtracting capital expenditures (C) and maintenance (M).

Q: What is AFFO vs. FFO?

A: FFO measures a REIT’s operational cash flow, focusing on leasing and acquisition activities, excluding non-cash items like depreciation and non-recurring gains/losses. AFFO refines FFO by deducting recurring capital expenditures (e.g., maintenance, upgrades) and adjusting for rent increases, providing a more accurate estimate of cash available for dividends. AFFO is preferred for assessing dividend sustainability, while FFO is more standardized but less precise.

Q: Can AFFO be negative?

A: Yes, if recurring costs (C, M) exceed FFO plus rent increases (R), indicating the REIT may struggle to sustain dividends without additional funding.