Home

Home

Back

Back

Definition: The 70/20/10 Budget Calculator helps you allocate your after-tax income into three categories: 70% for essential expenses, 20% for savings or debt repayment, and 10% for lifestyle or discretionary spending. It offers a simple framework for managing personal finances in high cost-of-living environments.

Purpose: This tool assists individuals in balancing essential expenses, financial goals, and personal enjoyment, promoting financial stability and flexibility for any income level.

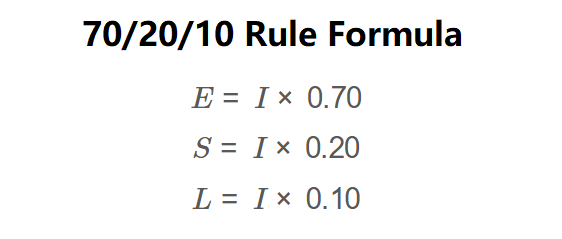

The calculator uses the following formulas:

\( E = I \times 0.70 \)

\( S = I \times 0.20 \)

\( L = I \times 0.10 \)

Where:

Steps:

Using the 70/20/10 rule is beneficial for:

Example 1: Calculate the budget for a monthly after-tax income of $5,000:

Example 2: Calculate the budget for an annual after-tax income of $60,000:

Q: What is the 70/20/10 rule?

A: It’s a budgeting strategy that allocates 70% of after-tax income to essentials, 20% to savings or debt repayment, and 10% to lifestyle spending.

Q: Can I adjust the percentages?

A: Yes, the rule is flexible. Adjust based on your financial needs, such as increasing savings or reducing lifestyle spending if essentials exceed 70%.

Q: How does it differ from the 50/30/20 rule?

A: The 70/20/10 rule allocates more to essentials (70% vs. 50%) and less to lifestyle (10% vs. 30%), making it better for high cost-of-living areas.