Home

Home

Back

Back

Definition: The 28/36 Mortgage Rule Calculator evaluates whether your debt levels meet the 28/36 rule, a guideline used by lenders to assess mortgage affordability. It calculates the front-end ratio (housing costs to income) and back-end ratio (total debt to income).

Purpose: This tool helps individuals determine if their current debts are within safe limits for mortgage approval or additional borrowing, ensuring financial stability.

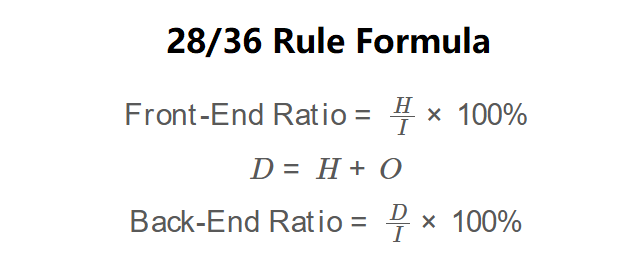

The calculator uses the following formulas:

\( \text{Front-End Ratio} = \frac{H}{I} \times 100\% \)

\( D = H + O \)

\( \text{Back-End Ratio} = \frac{D}{I} \times 100\% \)

Where:

Steps:

Calculating the 28/36 ratios is essential for:

Example: Check if your debts comply with the 28/36 rule with a monthly income of $4000, housing costs of $900, and other debts of $300:

Q: What is the 28/36 mortgage rule?

A: The 28/36 rule is a lending guideline where housing costs should not exceed 28% of monthly income (front-end ratio), and total debt should not exceed 36% (back-end ratio).

Q: What counts as housing costs?

A: Housing costs include mortgage payments, property taxes, homeowners insurance, and homeowners association fees.

Q: Can I still get a mortgage if I exceed the 28/36 rule?

A: Some lenders may approve loans with higher ratios, but it may require a higher credit score, larger down payment, or compensating factors.